7 October 2020, 11:40

A new mortgage scheme for homebuyers with a low deposit has been announced in the Budget. The Chancellor Rishi Sunak unveiled details of the scheme, which is designed to help those with a 5% deposit get accepted for a mortgage with the Government backing part of the loan. This scheme combines a mortgage with an equity loan and allows you to buy a brand new home in England. You need a minimum 5% deposit and the government lends you up to 20% of the cost of your.

5% Deposit Mortgage Loans

How does the new deposit mortgage scheme work and who is eligible? Find out about Boris Johnson's announcement.

Boris Jonhson announced on Tuesday (October 6) that he was going to turn 'generation rent into generation buy' with plans to help homebuyers.

In a speech to the virtual Conservative Party conference, the Prime Minister said up to two million people are missing out on owning their own home because they can’t save a large enough deposit.

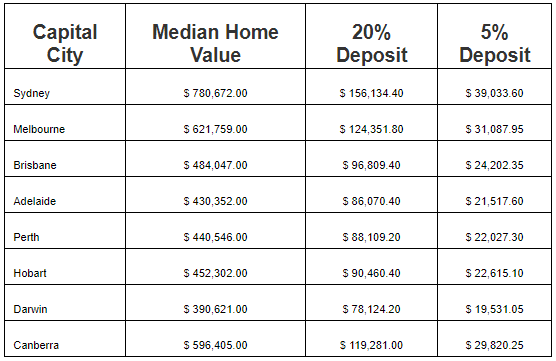

He said: “We need now to take forward one of the key proposals of our manifesto of 2019: giving young, first-time buyers the chance to take out a long-term, fixed-rate mortgage of up to 95 per cent of the value of the home - vastly reducing the size of the deposit.

“We will help turn generation rent into generation buy.”

But what is Boris Johnson’s new mortgage scheme and how does it work? Here’s what we know…

What is Boris Johnson’s new 5% deposit mortgage scheme?

The government hasn’t yet revealed the details about how the new scheme will work or when it is set to launch.

5% Deposit Mortgages

There's also been no word on who would be eligible to apply and how it will be calculated.

Many experts are suggesting it could be similar to the previous Help To Buy scheme which saw first-time buyers benefit from 5% deposits.

With this, home buyers could borrow up to 20% of the value of the property they wanted to buy from the government, or 40% in London.

The loan would then be interest free for five years, with property owners offered different ways to pay it off.

No Deposit Mortgages

These include adding the loan to their mortgage, paying it off when selling the house, or paying it off in cash instalments.

Meanwhile, the Telegraph recently reported that the PM has asked Ministers to draw up plans which could see banks remove 'stress tests' which were introduced after the financial crisis of 2008/09.

This means those who want to take out a mortgage will have to adhere to less criteria in order to secure a loan from the bank.

Currently, those who want a loan can expect assessments of income, expenditure and existing debts, verification of income, an assessment of future income, and 'stress tests' to see if they could keep up with repayment if rates were to rise.

Under new plans, this could potentially be relaxed, while a form of 'state guarantee' to lenders would be increased in order to balance out the risk.

5% Deposit Mortgage

This could be a way to encourage more banks to start lending to small deposit borrowers again.