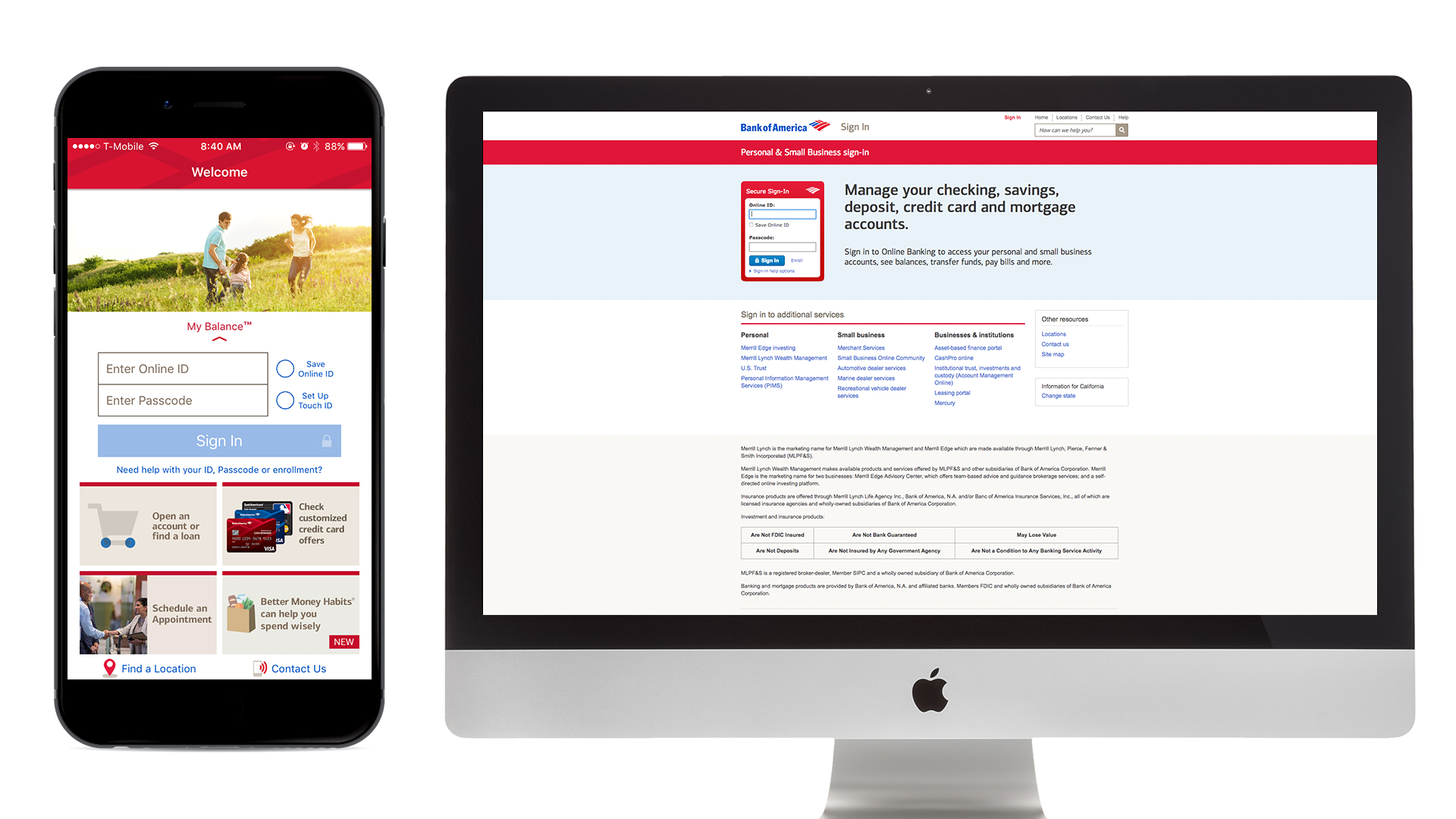

MLPF&S makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation. Bank of America Private Bank is a division of Bank of America, N.A., Member FDIC and a wholly owned subsidiary of Bank of America Corporation. By providing your mobile number you are consenting to receive a text message. Text message fees may apply from your carrier. Text messages may be transmitted automatically. Visit bankofamerica.com in your mobile web browser for a link to download the app. Bank of America, N.A. Go to the website of your bank or credit union to see whether it offers mobile check deposit. If it does, the website will often provide a download link to the bank's mobile app. Download the app onto a mobile device with a camera: Android, iPhone, and Windows devices are typically supported.

- Bank Of America Mobile Deposit Faq

- Bank Of America Coin Policy

- Bank Of America Mobile Deposit Cut Off Time

Personalize your app

Arrange the app’s features in a way that makes the most sense to you—on a per-device basis and move things around using the new dashboard feature. View our tutorial for details.

Bank Of America Mobile Deposit Faq

View balances and account activity

Search for transactions, add a note or an image, and filter by tags. Access up to 120 days of account transaction history, then accumulate more history going forward.

Make deposits using your device camera

Deposit checks into checking or savings accounts using the mobile deposit feature.

View e-Statements

e-Statements currently accessed in Online Banking are now available in Mobile Banking.

Touch ID or PIN authentication

Easily and securely log in using fingerprint, facial recognition or personal identification number.

Improved security

Utilizes a one-time passcode to complete certain transactions.

Link other accounts

Transfer funds

Transfer funds between your VirtualBank accounts and setup transfers with external bank accounts.

- User ID – 'Remember Me' capability

- Touch ID® for iPhone®

- Fingerprint Authentication for Android™ phones

- View check images

- Change your password from your phone

- Mobile Deposit limit display

- Auto-capture check image functionality when you deposit your checks

- View up to 90 days of mobile deposit history

- Change to a preferred landing page

- View, add, edit, and delete your payees and payments

- Import payees from contacts

- Select and view favorite payees for easy access

- Make person to person payments

Mobile Deposits

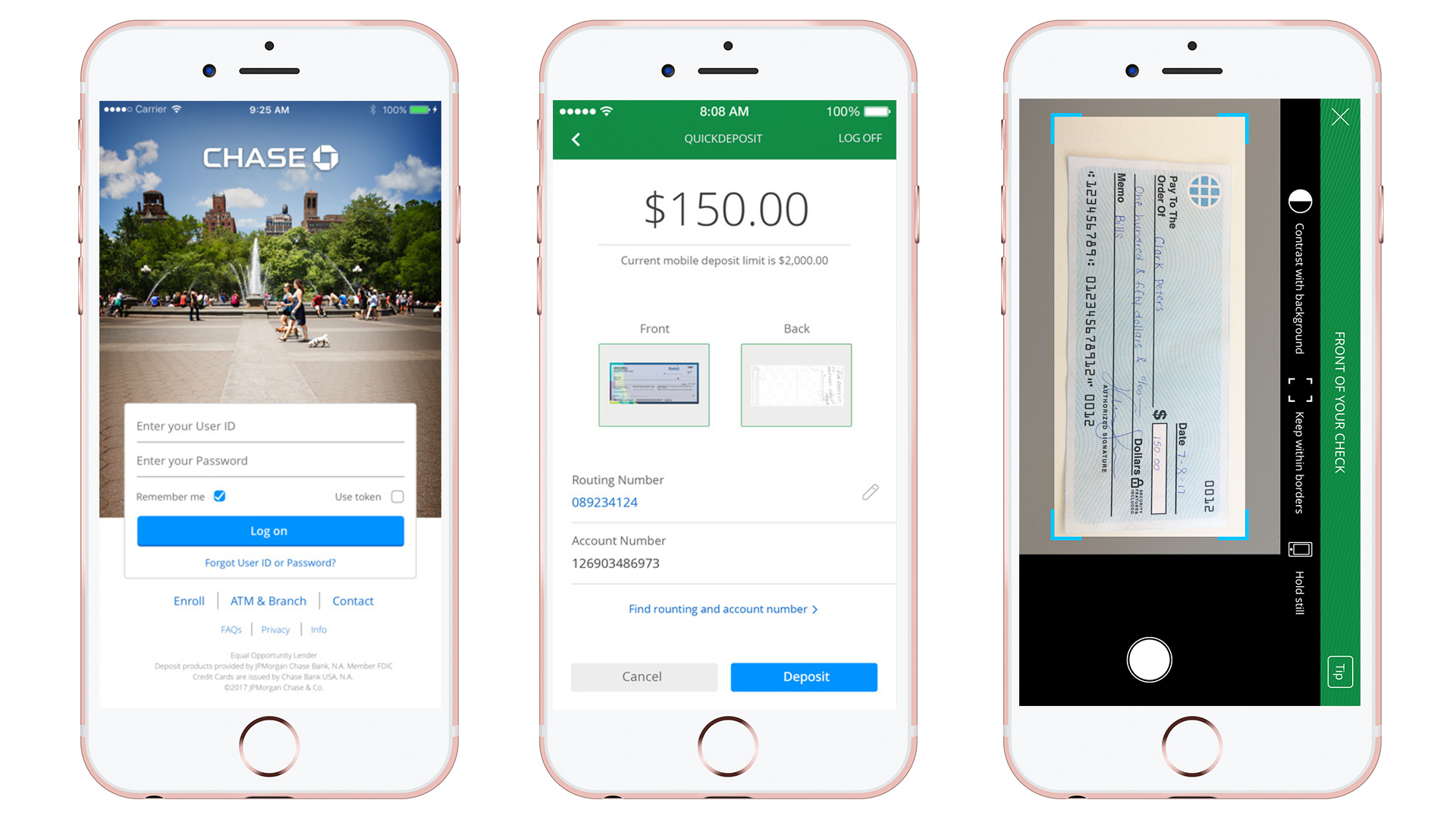

- Download and open our Mobile Banking app on your smartphone.

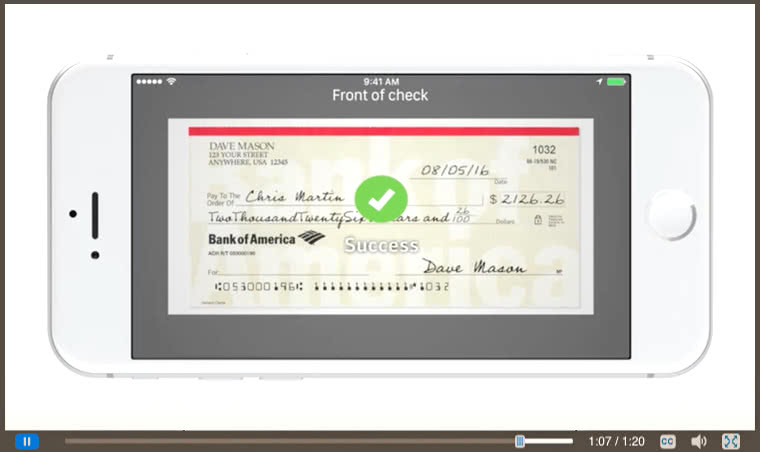

- Take photos of the back and front of the check(s) that you wish to deposit.

- Once you've successfully submitted your deposit, you'll receive an email confirmation.

- Mobile Deposits made by 8pm ET on a business day will be credited the same day.

Preview some of the features in our video.

Sign up for E-Statements

Bank Of America Coin Policy

statements in an instant. Plus, going forward, get up to 18 months of statement history through Online Banking.

Enroll your account(s) in minutes:

- Log into Online or Mobile Banking

- Select a deposit account

- Select “Documents”

- Click on “Documents and Settings”

- Enroll “All Accounts,” or place checkmarks next to account(s) you wish to enroll

- Click “Save Settings”

Mobile Banking FAQs

How do I sign out of the Mobile Banking app?

When you close the Mobile Banking app, you are automatically signed out.

Who do I contact with any questions about the app?

Any questions in reference to the feature/functions or issues relating to the app can contact our Client Service

at 1-877-998-BANK (2265).

How do I use the “organize accounts” feature to see my accounts in a certain order?

Bank Of America Mobile Deposit Cut Off Time

View the tutorial.

Can I send secure messages within the app?

Secure messaging is currently not available in the app but will be available in a future enhancement.

Is the email option available in the app a secure way to send information about my account?

No, the email option in the app should only be used for general questions or product information.

You should never enter your account number, login credentials or other non-public information in a

regular email.

How does the new feature of connecting to an institution work?

Connecting to an institution allows you to view your account information at other participating

financial institutions. Not all banks participate, so if your bank is not in the top 25 pick list you can try

entering your bank name in the search field. If your bank participates it will ask you to enter the login

credentials you use for that bank. If the bank does not participate, you will receive a message stating

“We don’t recognize this institution”.

Have more questions? Feel free to contact our Client Service Department at 1-877-998-BANK (2265)

Android is a trademark of Google, Inc.

With the convenience of mobile banking services, it’s pretty easy to deposit check by just taking a couple of photos with your phone. But it’s important to remember that you still have to be careful about what happens to that paper check; just ask the Arizona woman who is out $1,500 after using the Bank of America mobile app to deposit a check

It’s good practice to write “deposited” on any check you deposit with a mobile app, and then, once it’s been accepted by your bank, destroy it.

That’s a lesson one Bank of America customer customer learned the hard way — and lost a lot of money in the process: ABC 12 News in Arizona has the story of a woman who used the bank’s mobile app to deposit a check for $1,500.

“I read terms and agreements. I make sure I’m doing things the right way,” the Scottsdale resident told the news station.

But two months after she deposited the check, she says the bank debited $1,500 from her checking account with no explanation. She called the bank to find out what the heck was going on.

“And they said ‘We can’t tell you’,” she says. She did her own digging, and even filed a police report to uncover more information.

As it turns out, after she’d deposited the check, it was apparently stolen. Even though her mobile deposit of the check had gone through, someone — caught on grainy ATM video — was able to cash that check a second time. The scammer even added a second signature to the back.

This second cashing of the check resulted in Bank of America debiting the customer’s account for the amount of the earlier deposit.

BofA has been made aware of the situation, but seems to indicate that this is all on the customer’s shoulders.

“To help prevent checks from being negotiated more than once, customers using mobile check deposit are directed in our Mobile Check Deposit Agreement to write ‘Deposited’ on the check and destroy the original check promptly after the deposit has been acknowledged,” a spokesperson said. “As long as the ‘live’ check is still in existence, there is a chance that it could be negotiated more times.”

The bank added that it is “not at liberty to discuss the transaction information captured in ATM footage.”

The customer calls BofA’s response “disappointing,” and says she will be pulling all her accounts with the bank.

“I’ll never deposit anything mobily ever again,” said Rogers.

As with any banking document you receive, make sure you comb the fine print so you know how long you need to keep the original check, and your rights regarding disputes. And again, write a big fat DEPOSITED on it while you’re waiting for it to be accepted, and destroy it when all is said and done. Paper shredders are known to do the trick.

Editor's Note: This article originally appeared on Consumerist.