Table of Contents

- 1 About PNB Housing Fixed deposit

- 1.3 Documents Required

- SBI pays an interest rate of 5.30% p.a. For an investment period of 5 years for all regular term deposit holders When it comes to senior citizens, the rate of interest paid by the bank is 0.50% higher per annum For 5-year deposits, those who are 60 years and above can expect an interest rate of 5.80.

- PNB offers several fixed deposit schemes to cater diverse needs of the customers. A Different group of people can invest in schemes that serve their purpose and yield good returns. The bank offers the highest interest of 7.30% p.a. The minimum tenure of investment is 7 days and the maximum tenure is 10 years.

- An interest at 4% per annum will be paid to individuals who make a premature withdrawal within six months from the date of deposit. For premature withdrawals made after six months, an interest rate 1% lower than applicable on public fixed deposit for the period for which the deposit has run is offered.

- The interest rates for senior citizen fixed deposit account is around 7% P/A in Punjab national bank. It is usually 0.50% more than regular FD interest rates. Read More – Canara Bank Net Banking Login Guide. How to Open the PNB Fixed Deposit Account? You can open Punjab national bank fixed deposit account for Rs 25000 or more.

About PNB Housing Fixed deposit

PNB FD calculator online - Calculate PNB FD Interest rate using PNB Fixed Deposit calculator 2021. Check PNB FD rate of interest and calculate FD final amount via PNB FD Calculator on The Economic Times.

Fixed deposit is the safest mode of investment, which offers you higher returns on your investment. It not only offers you higher returns but at the same time, it offers you peace of mind as there is no market risk linked with this investment instrument. PNB Housing offers safe investment option for those who want to grow their money and earn higher interest. PNG Housing fixed deposit interest rates are higher than others. It offers various saving schemes to customers to make a choice. You can select any of these to invest your money for a pre-defined period.

PNB Housing Fixed Deposits Interest Rates

Regular Deposit Up to INR 5 Crore

| Tenure (Months) | Cumulative Option ROI (p.a.) | Non Cumulative Option ROI (p.a.) | ||||

|---|---|---|---|---|---|---|

| Return on Investment | Tentative Yield to Maturity | Monthly | Quarterly | Half Yearly | Yearly | |

| 12 - 23 | 6.20% | 6.20% | 6.03% | 6.06% | 6.11% | 6.20% |

| 24 - 35 | 6.45% | 6.66% | 6.27% | 6.30% | 6.35% | 6.45% |

| 36 - 47 | 6.60% | 7.05% | 6.41% | 6.44% | 6.49% | 6.60% |

| 48 - 59 | 6.60% | 7.28% | 6.41% | 6.44% | 6.49% | 6.60% |

| 60 - 71 | 6.70% | 7.66% | 6.50% | 6.54% | 6.59% | 6.70% |

| 72 - 84 | 6.70% | 7.93% | 6.50% | 6.54% | 6.59% | 6.70% |

| 120 | 6.70% | 9.13% | 6.50% | 6.54% | 6.59% | 6.70% |

Note – Senior Citizens can get special rates for deposits upto INR 1 Cr. Rest all terms and conditions remain the same.

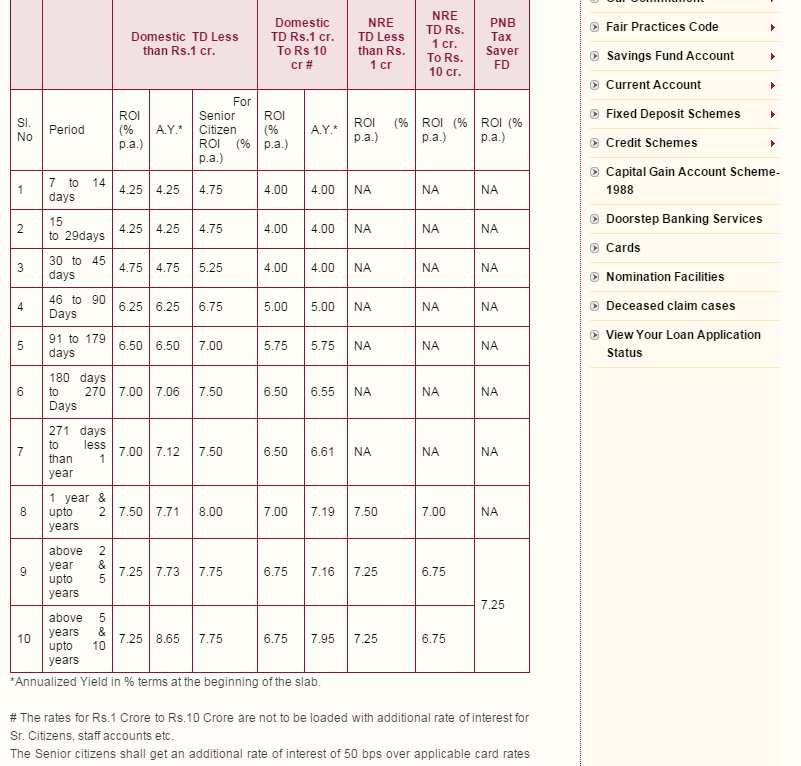

Pnb Fixed Deposit Rates

Benefits of PNB Housing Fixed Deposit

- PNB Housing fixed deposit has been ranked among the top investment tools for its features and benefits. Rated as CARE-AAA’ & CRISIL “FAAA/Negative”-this rating indicates that the degree of the safety regarding timely payment of interest and principal is very strong and high.

- No tax deductions for the interest amount below Rs. 5000 per financial year.

- Loan facility is available up to 75% of deposit amount from all branches of PBN housing and PNB.

- You get the facility of cheque encashment in respect of interest and repayment of deposits from any of the PNB branch.

- It also offers you facility of premature cancellation after 3 months based on the discretion of the company.

- You will get the nomination facility as per NHB guidelines.

- Special rate of interest for senior citizens additional 0.25% rate of interest applicable for deposits up to INR 1 crore.

Documents Required

- Duly filled application form along with recent photograph

- Age proof such as valid passport, the certificate of statutory authority, driving license, etc.

- Residence proof such as driving license, telephone bill, electricity bill, ration card, voter id, any other valid certificate from statutory authority.

Premature Cancellation

All fixed deposits have minimum lock in period of 3 months.

The interest rates for pre-payment of deposits as follows:

- If you will withdraw your money before the maturity, then you need to pay the penalty on that in form of lower interest. If you withdraw money after three months, but before six months, the maximum interest payable shall be 4% per annum for individual depositors & no interest in the case of another category of deposits.

- If you will withdraw your money after six months but before the date of maturity, in that case, you will get 1% lower interest than the actually applicable interest rate to a public deposit for the duration of which you have fixed the amount.

Make hay while the sun shines. The saying fits aptly to fixed deposit market whose weak sentiments seem to be a thing of the past with returns starting to tread the upward territory. The latest is that the leading pressure cooker manufacturer Hawkins Cookers Ltd has launched a new fixed deposit scheme offering interest to the tune of 10.75% per annum for a 36-month deposit. The effective yield, which adds on to the interest rate offered, goes up to 11.30% p.a. The minimum deposit amount needed to earn such interest is ₹25,000.

At a time when banks are offering returns of 6%-8%, the news of double-digit returns is a sheer welcome for all those wanting the assurance of capital as well as good returns over a period of time. Even though Hawkins may be offering the highest, there are some more non-banking financial companies (NBFCs) that give double-digit returns on fixed deposits. Want to know which are they? Keep reading.

Table of Contents

- 1 10% Fixed Deposit Interest Rates of NBFCs

- 1.1 List of Banks/NBFCs Offering 7%-10% Return on Fixed Deposits

10% Fixed Deposit Interest Rates of NBFCs

Pnb Fd Rates Today

A fine list of NBFCs with double-digit returns is shown in the table below.

| NBFCs | Fixed Deposit Scheme | Effective Yield Applicable (In Per Annum) | Minimum Deposit Needed (In ₹) | Minimum Deposit Tenure Needed to Yield Double-digit Return |

|---|---|---|---|---|

| Hawkins Cookers Ltd | Hawkins Cookers Fixed Deposit Scheme | 11.30% | 25000 | 3 Years |

| Mahindra & Mahindra Financial Services Limited | Samruddhi Cumulative Scheme | 10.07% (Normal) 10.32% (Senior Citizens) | 5000 | 5 Years |

| Shriram City Union Finance | Cumulative Deposit | 10.42% (Normal) 10.77% (Senior Citizens | 5000 | 5 Years |

| KTDFC Ltd | KTDFC Fixed Deposit Scheme | 10.17% (Senior Citizen) | 10000 | 5 Years |

To be investing and to be investing for the future are two different things altogether. Well, the latter would grab your attention, isn’t it? Your future is in good hands when there’s an assurance of getting back the capital invested, along with reasonably good returns to withstand the inflation prevailing in the market.

And, if you are ears to economic developments doing the rounds, you must know the consumer price-based inflation is hovering around 3.70%-4.20% mark. So, your fixed deposit investments must at least fetch a return of 7%-10% to counter the inflation better. Let’s check out the banks and NBFCs that deliver such returns to the depositors.

List of Banks/NBFCs Offering 7%-10% Return on Fixed Deposits

Check out the list of the banks, NBFCs and small finance banks offering 7%-10% fixed deposit interest rates, in the table below.

Pnb Fixed Deposit Rates Calculator

| Banks/NBFCs | Interest Rate/Effective Yield (In Per Annum) | Minimum Deposit Needed (In ₹) | Maximum Deposit Needed(In ₹) | Minimum Deposit Tenure Required |

|---|---|---|---|---|

| State Bank of India (SBI) | 7.20%-7.35% (Senior Citizens) | As Applicable | Above 10 Crores | 1 - 10 Years |

| HDFC Bank | 7.00%-7.40% (Normal) 7.20%-7.90% (Senior Citizens) | 5000 | Greater Than Equal to 5 Crores | 9 Months 1 Day - 10 Years |

| ICICI Bank | 7.00-7.95% | 10000 | Greater Than Equal to 500 Crores | 61 Days - 10 Years |

| Axis Bank | 7.00-7.70% (Normal) 7.25%-8.10% (Senior Citizens) | 5000 | 100 Crores and Above | 6 Months - 10 Years |

| Kotak Mahindra Bank | 7.00%-7.90% | 5000 | 25 Crores and Above | 180 Days - 2 Years |

| IndusInd Bank | 7.00%-8.50% | 1000 | Less Than 5 Crores | 270 Days - Less Than 61 Months |

| YES Bank | 7.00%-7.71% (Normal) 7.50%-8.24% (Senior Citizens) | 10000 | Less Than 1 Crore | 46 Days - 18 Months 18 Days |

| Canara Bank | 7.00%-7.29% (Normal) 7.20%-7.82% (Senior Citizens) | 5,00,000 | Less Than 1 Crore | 1 Year - 555 Days |

| DHFL | 7.85%-8.75% (Normal) 8.25%-9.15% (Senior Citizens, Defence Personnel, Widows, as well as home loan, mortgage loan and SME loan customers of DHFL) | 5000 | Up to 5 Crores | 1 Year |

| Bajaj Finserv | 7.35%-8.40% (Normal) 7.60%-8.65% (Employees or customers of fixed deposits and loans of Bajaj Group) 7.70%-8.75% (Senior Citizens) | 25000 | As Applicable | 1 Year |

| Sundaram Finance | 7.45%-7.75% (Normal) 7.95%-8.25% (Senior Citizens) | 10000 | As Applicable | 1 Year |

| Bandhan Bank | 7.40% (Normal) 8.15% (Senior Citizen) | 1,000 | As Applicable | More Than 18 Months - Less Than 1 Year |

| RBL Bank | 7.00%-7.98% (Normal) 7.50%-8.51% (Senior Citizen) | As Applicable | Up to 3 Crores | 46 Days - Less Than 36 Months |

| IDFC Bank | 7.00%-8.25% (Normal) 7.50%-8.75% (Senior Citizen) | As Applicable | Less Than 1 Crore | 181 Days - 5 Years |

| Fincare Small Finance Bank | 7.00%-9.00% (Normal) 7.50%-9.50% (Senior Citizen) | 1,000-5,000 | Less Than 1 Crore | 181 Days - 36 Months |

| Utkarsh Small Finance Bank | 7.00%-9.00% (Normal) 7.50%-9.50% (Senior Citizen) | 1,000 | Less Than 1 Crore | 211 Days - Less Than 2 Years But More Than 455 Days |

| ESAF Small Finance Bank | 7.50%-8.75% (Normal) 8.00%-9.25% (Senior Citizen) | 1,000 | Less Than 1 Crore | 180 Days - 727 Days |

| Jana Small Finance Bank | 7.00%-8.50% (Normal) | 1,000 | Less Than 1 Crore | 61 Days - More Than 2 Years to Up to 3 Years |

| Ujjivan Small Finance Bank | 7.50%-8.50% (Normal) 8.00%-9.00% (Senior Citizen) | 1,000 | Less Than 1 Crore | 180 Days - 799 Days |

| Suryoday Small Finance Bank | 7.50%-9.31% (Normal) 8.00%-9.84% (Senior Citizen) | 1,000 | Less Than 1 Crore | 181 Days - 950 Days |